Welcome to the inside of a professional engineer’s brain! I was introduced to financial independence (FI) in December of 2018 and can NOT stop myself from researching and analyzing all things related to FI. While I am by no means an expert in this field I believe I have developed a solid foundation for anyone and everyone to become financially independent. So come join me in the path that will lead to a life full of happiness and freedom.

Who is this blog designed to help? Anyone who is interesting in getting off the proverbial hamster wheel of life to accelerate their path towards financial independence. At the end of this path you will be rewarded with the option that most people won’t be able to feel until their 60’s or 70’s: FREEDOM!

The acronym FIRE means financially independent and early retirement. It is a lifestyle choice based on the premise of creating habits that will allow you to save 25 times your annual expenses. Once you have accumulated the wealth you are considered financially independent and have the freedom to pursue your true passion.

The path to FI begins with these first three steps.

- Find out where you are.

- Set your goal

- Plan your path and STICK TO IT

Find Out Where You Are

There are many financial websites out there that allow you to track your expenditures and assist with financial transparency. In the FIRE community we like to use Personal Capital. This company is led by several very talented and experienced people in the financial world and they have taken a straightforward approach towards wealth management. It is free to sign up for and it only takes about 10 minutes to link your accounts to the site.

Set Your Goal

The most important thing, and personally the hardest, is to define what financial independence looks like for you. The question you are trying to answer is, “If you had an unlimited amount of time and complete control over your life, what would you want to do?” I asked my wife this question and I got the proverbial, “I dunno”. It truly is a very difficult question to answer because the options are limitless and can change several times while traveling down your self-defined FI path. While I don’t have every single day planned out after we reach FI I know this is what I told my wife I wanted to start every morning:

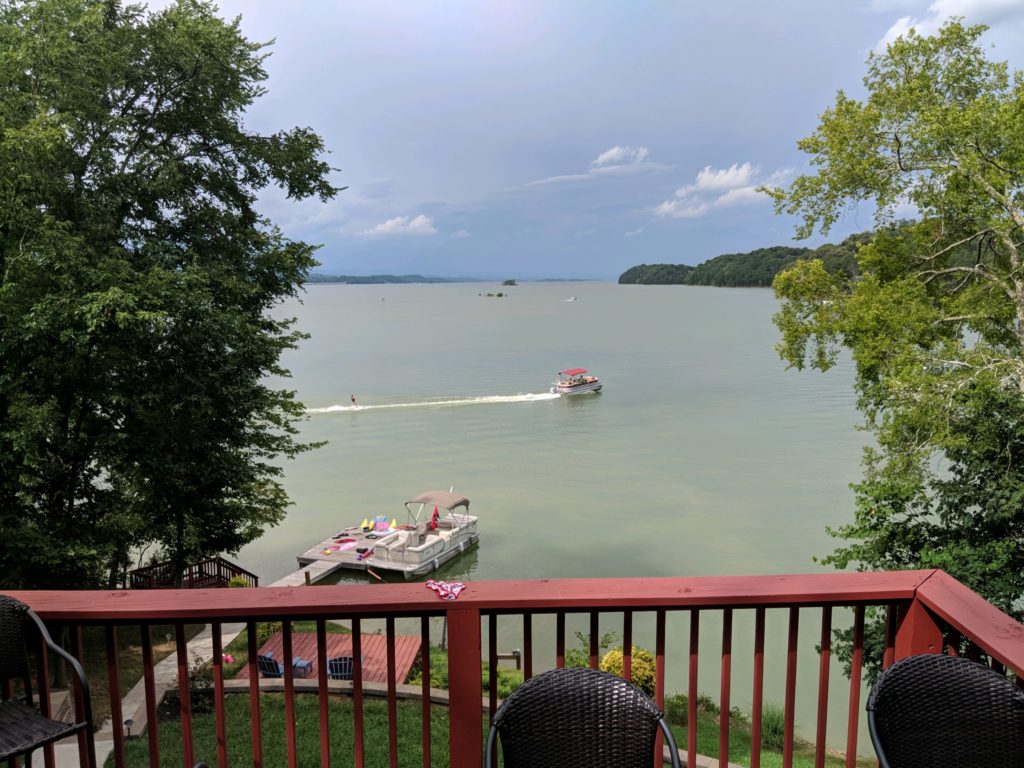

“My dream life is to wake up just before the sun rises, walk into our kitchen and construct the perfect cup of coffee. I would then take that cup of coffee and walk out to our porch where I have a beautiful overview of a lake our mountain side just as the sun is cresting the horizon. I can sit there alone in my thoughts and listen to nature as it provides a peaceful soundtrack of life and tranquility. Once the wife wakes up I go back into the kitchen and start making breakfast for the two of us. Once breakfast is done we take the freedom we earned from the FIRE community and pursue what we truly love.”

This is the part in the conversation where the choices are limitless and haven’t been defined yet. I am an aspiring woodworker and strive to build beautiful and useful pieces of furniture. I will, hopefully, have some articles showing you some of the projects I have constructed.

Plan You Path and STICK TO IT

The triangle has long been utilized as one of the strongest shapes in architecture and engineering design. We will use the same building shape to construct the path to FI. Most of the articles in this blog will be focused on a three step process. Included throughout this process I will be striving to create an Engineer’s Toolbox full of worksheets that will provide you with a personalized path to FI. Click here to access the Engineer’s Toolbox now!

To first step to creating a successful path is creating a solid foundation. In my foundations article you will learn the concepts of quickly getting out of debt, setting up an emergency fund, and learning the basics of investing. There will also be articles including how to keep college debt down, purchasing your first house, buying a vehicle, and the different “wallets” you can put your money into.

Once a solid foundation has been formed, you can start to construct the habits that will accelerate your path to FI. This is what I would call the living quarters of your life. The living quarter’s section includes information on developing a side hustle, living a frugal lifestyle, calculating your savings rate, where exactly to put your money and how to extract it, and much more! Inside of the Engineer’s Toolbox you will find Excel worksheets allowing you to tailor your pathway to FI.

Once you have accelerated your path to FI you can start to take advantage of some of the life hacks that the FI community has perfected. This includes a method on how to never have to pay for a vacation again through travel rewards, second generation FI, and geoarbitrage.

What’s next? Start with these foundation article links to begin your customized path!